| ✍️ Editor's note: We strive to provide objective, independent advice. When you decide to use a product or service we link to, we may earn a commission. Learn more. |

This article contains both a simple and advanced rental property calculator that will let you model any deal to quickly forecast potential returns with confidence.

Over the past few years I’ve grown my real estate portfolio from a small 4plex that I house hacked, to 22 apartments worth over $1.6 Million dollars.

While growing my portfolio, I’ve looked at hundreds, if not thousands of deals, and one thing became very clear: investing in real estate is a numbers game, and cash flow is king.

If you’re able to project how a rental property is going to perform, and you’re able to understand exactly how much cashflow you’re going to have after your mortgage and expenses, you can build a successful portfolio.

However, understanding how an investment property is going to perform can be very difficult to do without the right tools.

Properties that look nice and seem like they might be a good deal often end up being bad investments that would lose you money every single year if you made the mistake of purchasing them.

A great rental property calculator takes the guesswork out of forecasting your cash flow, and makes it much easier to grow a profitable portfolio.

In this article, I’m going to give you one of the most important tools in any real estate investor’s toolbox: a financial model for rental property that you can stand behind.

JUMP TO SECTION

- Online rental property calculator

- My personal rental property calculator spreadsheet that I use (free)

- A video tutorial where I model a real deal and discuss expenses

- What is a good return for a rental property?

- How do expenses change with bigger properties?

- Cash on Cash Return Vs Cap Rate

- Glossary Of Key Rental Property Terms

Rental Property Calculator

Advanced Rental Property Calculator (free)

The calculator above is a great resource to quickly check if a rental property has the potential to be a good investment, but is still missing some important information you’d want if you’re seriously evaluating a property for purchase.

If you’re interested in taking a deeper dive on a property, I built a more advanced calculator that also shows you:

- A breakdown of expenses by category

- Purchase and Pro-forma cap rates

- Income-to-Expense Ratio (the 1% rule)

- Gross Rent Multiplier

- Debt-Service-Coverage Ratio

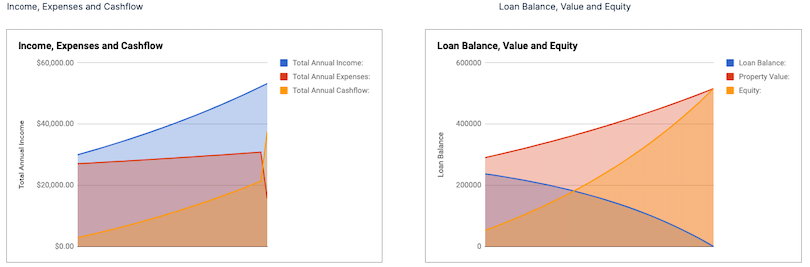

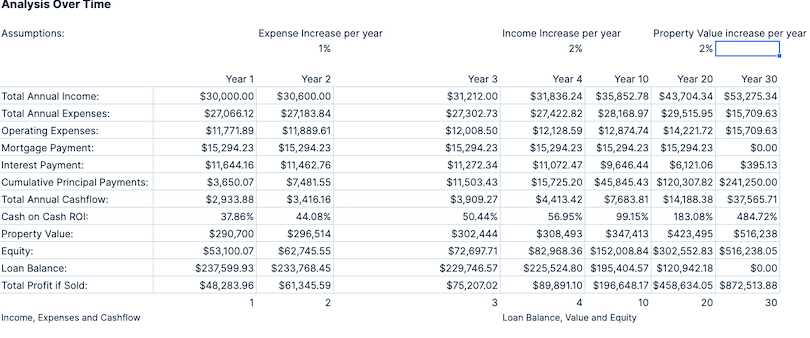

- Charts that show projected income, expenses, and cash flow projections for the next 30 years

- The ability to add in leasing fees

- The ability to add in additional income (laundry, RUBS, etc)

Here is what the output of this tool looks like.

You can get this tool for free by clicking a link below – it takes you to a Google Sheet with this calculator. Simply make a copy of it, and you have an incredible resource to model investment properties!

Advanced Rental Property Calculator (free)If you’re a new investor and are a bit nervous about understanding how to make sense of this tool — don’t worry! I’ve included a video tutorial in which I walk you through exactly how to use this calculator to model a real property, and talk through all of the inputs and outputs on the calculator.

Video Walkthrough — Modeling An Actual Deal

In this video I use the advanced calculator to model a real deal I found on Zillow, and talk through how I estimate expenses using just listing photos, and decide whether a deal is worth further diligence.

What Is a Good Return for a Rental Property?

When it comes to investing in real estate, a "good" return can be very different based on each individual investor and their goals.

Some investors are looking for cash flow, while others are simply looking to break even on cash flow and make their money through appreciation in value and tax write-offs.

My partner and I invest in the St. Louis market and our strategy is to mostly buy properties on "the fringe" — areas that have good cash flow with a lot of potential for appreciation in the next five or so years.

For these properties we’re aiming for above a 15% cash-on-cash return, and we’re looking for deals that we can refinance and pull out all of our capital once we finish renovations and leasing (the BRRRR Strategy).

However, when hunting for deals in nicer areas, I generally look for properties that meet the 1% rule, where monthly rents are 1% or greater than the purchase price of the property, and cash-on-cash returns are above 8.5%.

It’s worth noting that the 1% rule is just a guide and doesn’t apply to all markets. In fact, you should ignore it completely for anything that rents for less than $700, as you would want closer to a 1.5% or 2% number for a deal with lower rents to pencil out.

How Do Expenses Change On Bigger Properties? (Don’t make this mistake)

One the most common mistakes new investors make is not accurately modeling expenses for their properties. I think a lot of this comes from some of the advice out there that recommends simply modeling certain percentages of rent for repairs and capital expenditures.

This is an incredibly dangerous way to model your rental properties and will almost always be wrong.

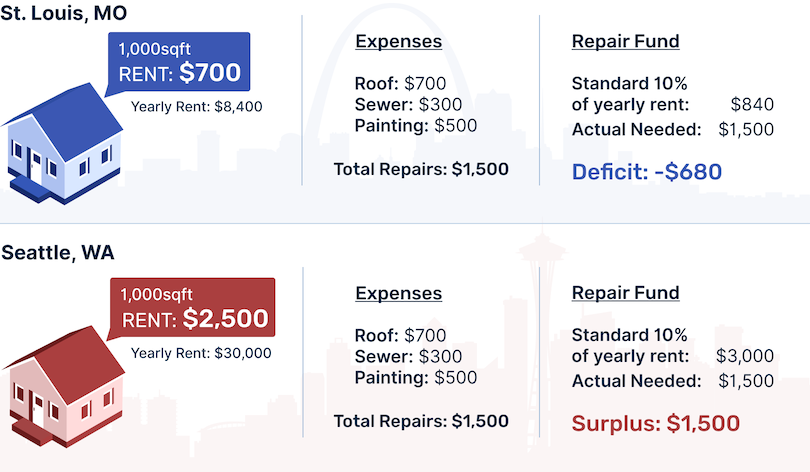

For example, a 1,000-square-foot house in Seattle and a 1,000-square-foot house in St. Louis are going to have similar expenses for maintenance (roof, sewer, painting, etc), but drastically different rents.

One property might rent for $2,500 and the other for only $700. If we were to do a "standard" 10% for repairs, our Seattle house would have a yearly escrow of $3,000 for repairs, and our St. Louis house would only have $840 set aside for repairs.

With this in mind, one of the most important things you need to learn to use this model successfully is how to accurately predict expenses. When I was a new investor, this was one of the hardest things for me to learn.

With time, you will be able to look at pictures of a listing online and analyze the condition of a property, along with what repairs it will likely need in the future — and add that into the model.

You can see this in action in the graphic above and view some related articles on how to accurately forecast renovations and repair expenses below.

Cash-on-Cash Return vs Capitalization Rate

Real estate investors will often debate which metric is more important: Cash-on-cash return or cap rate.

They are both very important, but for different reasons. Depending on the goals for your investment, one metric will be more important than the other.

Cash-on-cash return is a great metric for investors that are looking for cash flow, as it’s easy to understand that a 20% cash-on-cash return of a $100,000 investment yields $20,000 per year.

It’s also easy to compare to the stock market, although this can be a bit misleading, as real estate income is generally tax advantaged compared to dividends earned in the stock market, and doesn’t take appreciation into account.

However, more experienced investors often focus on cap rate, as it allows them to make a larger amount of money faster. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream.

If you buy a property that trades at an 8% cap rate, then raise the net operating income of the property by $5,000, you can divide that by the 8% cap rate. You’ve just generated $62,500 in value!

Good investors that are able to increase net operating income (NOI) are often able to achieve several years of cash flow in value created through forced appreciation.

Personally, I look for properties that cash flow when I buy them, but have tons of room to increase income, so I can benefit from forced appreciation and capture that equity through a refinance in the future.

Glossary Of Key Rental Property Terms

| Term | Definition |

| Cap Rate | Capitalization rate, or cap rate for short, is the annual yield of a property - What percentage of the purchase price would it return every year if you purchased it in cash |

| Net Operating Income (NOI) | How much income does the property generate after all non mortgage expenses |

| Debt Service Coverage Ratio | How much free cash is available to pay debt obligations. |

| Gross Rent Multiplier (GRM) | Gross Rent Multiplier is the number of years it takes for a property's gross rents to equal the purchase price. |

| Amortization Term | The total length of time it takes to payoff a loan |

| Vacancy Rate | What percentage of the time is your property vacant |