The buyer’s agent fee is the commission that a real estate agent earns for finding and securing a home for a buyer. Usually it’s half of the total commission that a seller is offering, or 3% of the sale price.

The seller compensates the buyer’s agent from the proceeds of the sale, so the buyer is not on the hook for a payment. We surveyed agents and found that less than 1 out of 100 had a buyer pay their commission in the past. The rare exception is when a seller refuses to pay the full commission.

A buyer's agent takes a buyer through the search, offer, and closing process for a home. At closing, the commission checks are deducted from the proceeds of the home and paid to the agents.

Some agents and real estate companies offer buyer rebates or cash back as a way to attract buyers. Semya-Moya, for example, will match you with a top local buyer's agent and you could qualify for cash back.

💰Find a top agent & earn cash back

Find a top local agent from a trusted brand like Keller Williams or RE/MAX. Earn cash back when you buy your dream home.

Changes to buyer's agent commission may be coming

A November 2023 lawsuit found the National Association of Realtors (NAR), Homeservices of America, and Keller Williams Realty guilty of misleading sellers into paying high realtor fees.

Traditionally, the seller pays the entire 5-6% commission, which is then split between the seller's and buyer's agent. The lawsuit argued that this system unfairly inflates home sale costs for sellers, as they are required to pay commission to a buyer's agent who is working against their interests.

The verdict suggests that this practice could change, with buyers potentially responsible for paying their own agents' commission.

While no significant changes are expected in the short term, we will continue monitoring the situation and updating our content accordingly.

» READ MORE:

- NAR lawsuit: After a $1.8 billion verdict, the clock is ticking on the 6% real estate commission

- Backgrounder Q&A: National Association of REALTORS

Why does a seller pay the buyer’s agent commission?

A seller pays buyer’s agent a commission as an incentive to the buyer’s agent to entice them to show the property. The thinking is that more showings will result in a higher price and a faster sale. When sellers offer a lower buyer’s agent commission, the property stays on the market for longer.

Who pays the buyer agent fee?

To decrease the out-of-pocket cost of selling a home, the seller pays the buyer’s agent from the proceeds of the sale. This allows buyers to buy a home with less cash and it allows sellers to sell more quickly. While buyer’s agents sometimes advertise their service as free to the buyer, there is evidence that this isn’t always the case.

In fact, you could easily imagine a scenario where the majority, if not all, of the buyer’s agent commission is incorporated into the price of the home.

If someone is selling a home for $100K and offering a buyer’s agent $3K, then they are willing to receive a final payment of $97K. Imagine now, that instead of paying the buyer’s agent, a buyer simply offers the homeowner $97K. The homeowner receives $97K in both cases, however, the buyer pays $3K less in the second scenario.

Both are technically true and depending on who you ask, you may get a different answer. As a buyer, what you need to know is that there is usually no out-of-pocket cost for you to work with a buyer’s agent.

When does a buyer have to pay their agent?

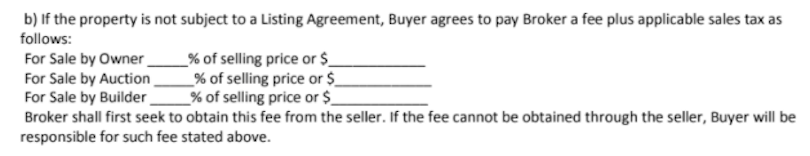

Buyers rarely have to pay their agents out of pocket.* The buyer’s agency agreement includes a provision to guarantee that the buyer’s agent gets paid, even if the seller refuses to do so. The particular section of the contract looks like this:

In the agreement, the buyer is responsible for paying the buyer’s agent if the seller does not pay. However, the buyer’s agent must first seek to get the fee directly from the seller. The particular contract in the example outlines the most common scenarios when something like this might occur.

- For sale by owner (FSBO): When an individual sells their home without an agent, they are often reluctant to pay a broker fee. Luckily, this scenario is relatively rare, and most experienced agents know how to work with the seller to get their commission.

- For sale by auction: Homes being auctioned off usually don’t have a seller’s agent involved. The compensation for representation on this kind of transaction will vary based on your location. It’s best to get an agent experienced in home auctions.

- For sale by builder: New construction projects usually offer compensation to buyer’s agents directly. However, some builders may try to justify lower rates with the relative simplicity of selling a brand new home, leaving the buyer to pick up the difference.

Read your contract carefully because these contracts vary between states and brokerages. Discuss the possibilities with your agent and get a firm understanding of if and when you would have to pay their commission.

*Note: We sourced the experiences of over 50 agents and found that buyers were on the hook for a commission only in extremely rare circumstances (less than 1%). In fact, most of the agents had only collected a commission from a buyer once or twice in their entire careers.

Is the buyer’s agent fee worth it for the buyer?

The accurate but disappointing answer is that a buyer’s agent fee is worth it in some circumstances. For example, it’s a common misconception that everyone shops for a home online, in fact, 52% of buyers report hiring a buyer’s agent specifically to help them find a home. Buyers who worked with an agent also appreciated:

- Help understanding the transaction steps (61%)

- Agents pointing out unnoticed features/faults with property (60%)

- Help negotiating better sales contract terms (48%)

Buyers that fall into one or more of these categories should work with an agent. Some buyers have been through the process multiple times, have a legal background, or are otherwise comfortable with the home buying process. For these buyers, a buyer’s agent is less likely to deliver significant value.

What work does a buyer’s agent do for a client?

A buyer’s agent helps a buyer navigate the search, offer, and closing process of a home. During the search process, an agent helps the buyer find properties, arranges showings, and gets any relevant information about the property like the tax statements and utility bills.

When the buyer is ready to make an offer, the buyer's agent analyzes competing properties, suggests a price, and writes a formal offer letter. This kicks off the negotiation process in which a buyer’s agent tries to get the best mix of price, terms, and concessions for the buyer.

Once the seller accepts the offer, the buyer’s agent pushes the home through the closing process. This involves getting a loan approved, monitoring all the dates and requirements outlined in the contract, and finally, attending the closing. The buyer’s agent is compensated only after this final stage is completed.

Can I save money on buyer’s agent commission?

A commission rebate is the simplest strategy buyers can use to get some extra money in the homebuying process. After the closing procedures and transfer of ownership, the buyer’s agent pays the client, completing the rebate. Unfortunately, some states have outlawed this practice, a move many researchers agree is anti-competitive and not consumer friendly.

We don’t recommend first time buyers employ advanced strategies when purchasing a home. The following strategies involve more work and risk, than a commission rebate:

- Skip the agent: If you don’t work with an agent, you can potentially negotiate a lower price with the seller.

- Agree to dual agency: Having the seller’s agent represent you can also save you money. Just make sure you’re comfortable representing your own interests.

- Become a realtor: If you have a few weeks or plan to buy homes as an investment, you might want to get your real estate license. As your own agent, you’ll be entitled to half of the commission at closing.

A much less risky way of saving on buyer's agent commission is to work with a realtor who offers buyer rebates or cash back. For example, eligible buyers who get matched with an agent through Clever can get cash back for the purchase of their home!

Buy your dream home with a top local realtor from a trusted brand like Keller Williams or RE/MAX. Keep more money in your pocket by earning cash back on eligible purchases.

Enter your zip code to request hand-picked agent matches in minutes. Compare your options until you find the perfect fit, or walk away with no obligation. Try Clever's free service today!

Key Takeaway

As a buyer, you won’t need to pay your agent out of pocket. Instead, the seller compensates both agents from the proceeds of the sale. Most buyers choose to work with a buyer’s agent, but many don’t know that they can get some extra money in the process. The easiest method to get extra cash without compromising on services is a commission rebate.