How does an HOA work? | Types of HOAs | Homeowners association fees | Why do HOAs exist? | Pros | Cons | FAQs

A homeowners association (HOA) is a membership-based organization that manages a residential development with common areas, such as recreational facilities, shared walls, or private roads. These residential developments are called either common-interest communities (CICs) or common-interest developments (CIDs).

HOAs are very common. A quarter of all housing stock in the U.S. is part of an HOA, and 73 million Americans live in one. Since 1970, the number of HOAs has soared from just 10,000 to 351,000 in 2019:

If you’re thinking about moving to an HOA, it’s important to make sure that it fits with both your finances and your lifestyle. Some people love HOAs while others avoid them at all costs.

An HOA may be for you if:

- You like living in a community where everyone follows the same rules

- You want less responsibility for upkeep and maintenance

- You value a community that offers social events and amenities

An HOA may not be for you if:

- You plan to renovate your home, especially the exterior

- You value your autonomy and don’t want to be micromanaged

- You may have difficulty paying the HOA fees on top of your mortgage

How does an HOA work?

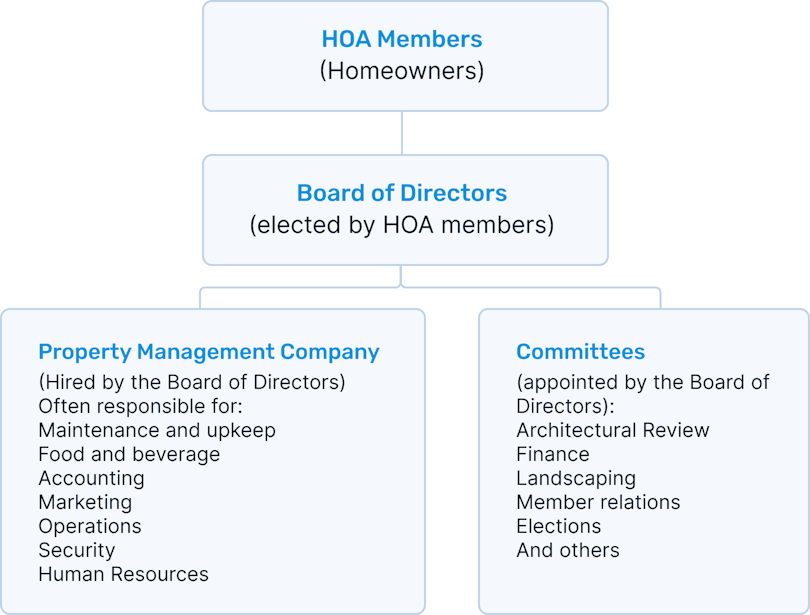

An HOA is made up of HOA members — who are the homeowners in the common-interest development (CID) — and a board of directors. The CID — also called a CIC (common-interest community) — is the community that the HOA governs. The size of the board varies depending on the size of the CID, but it usually consists of a President, Vice-President, Treasurer, and Secretary.

The HOA is governed by its Covenants, Conditions, and Restrictions (CC&Rs), with more day-to-day rules and regulations set out in its bylaws and rules and regulations. All HOA members must comply with the CC&Rs, bylaws, and rules and regulations, which are enforced by the board of directors.

Becoming an HOA member

When you buy a home in a CID, you automatically become a member of the HOA. You also receive a copy of the CID’s CC&Rs so that you know what rules to follow and how the community is governed.

Being a member of an HOA gives you certain rights, including the right to:

- Propose changes to the CC&Rs, bylaws, and rules and regulations, which are then usually voted on by other members

- Elect members of the board of directors

- Stand for election to the board of directors

- Access HOA financial statements and other official documents

- A fair hearing if accused of violating the CC&Rs, bylaws, or rules and regulations

- Challenge a special assessment or increase in dues

- Sue board members for alleged wrongdoing or mismanagement

In many states and HOAs, members also have the right to vote on special assessments that exceed a certain threshold. For example, a special assessment in California requires a majority vote by HOA members if the special assessment is more than 5% of the HOA’s budgeted expenses for a given year.

How is the board elected?

The board of directors is elected by the members of the HOA. Each HOA has its own process for electing members, which is set out in the CC&Rs. Generally, there are three ways to vote:

- In person

- By mail

- By proxy (i.e., another HOA member votes on your behalf)

As a member, you’ll be given notice of when elections take place and how to vote. The frequency of elections varies by state and HOA, but they are generally every few years. Some HOAs have term limits to ensure a healthy turnover of directors. In a few states, term limits are set in law.

What does the board do?

The board of directors’ responsibilities vary depending on how big the HOA is and what services and amenities it offers. Most importantly, all HOA board members have a fiduciary duty. This means that they must put the interests of the CID before their own self-interests.

At most HOAs, the board is responsible for:

- Enforcing the HOA’s CC&Rs, bylaws, and rules and regulations

- Collecting fees and special assessments

- Holding meetings

- Maintaining financial records

- Disbursing funds

- Resolving disputes related to the CC&Rs, bylaws, and rules and regulations

- Maintain common areas, structures, and facilities

The board can also appoint officers and form committees to oversee certain aspects of the HOA’s management. For example, many larger HOAs have an architectural review committee to ensure any renovations or newly-built structures conform with the HOA’s architectural guidelines.

Many HOAs also hire property management companies to help with the day-to-day operations of the community. The property management company assists with things like accounting, maintenance, member relations, and marketing.

Types of HOAs

Many different types of HOAs exist, but they can usually be grouped into one of three main categories:

- Planned communities

- Condominiums

- Co-operatives

A single HOA might also mix some of these categories together. For example, one HOA may have a planned community consisting of both single-family homes and condominiums.

The breakdown of different HOA types across the U.S. looks like this:

Let’s take a closer look at how each type of HOA works.

Planned Communities

A planned community usually consists of single-family homes or townhomes. Gated communities almost always fall into this category, although not all HOAs are gated.

When you buy a house in a planned community, you own both the house itself and the land it sits on. Common areas, such as parks, streets, and recreational facilities are owned by the HOA.

While you do own your land and the exterior of your house, that doesn’t mean you can make whatever changes you feel like to them.

For example, your HOA may have guidelines about which flowers and trees can be planted. In fact, landscaping may be managed entirely by the HOA, in which case you will have little control over how your yard and garden look.

Condominiums

When you purchase a condominium, you own your unit, but exterior walls and shared spaces are considered common property. Every condo member owns a share of this common property.

As in a planned community, the HOA — often called a condominium owners association (COA) in condominiums — enforces the condominium’s CC&Rs and bylaws. It also maintains common areas, such as fitness centers, lobbies, elevators, pools and rooftop patios.

In some states, COAs are treated a bit differently than other HOAs. For example, in Florida, directors of a COA are generally not allowed to serve for more than eight years, but this rule does not apply to non-condominium HOAs.

» LEARN: 7 Red Flags to Look for When Viewing Condos for Sale

Co-operatives

The final type of HOA is a co-operative. When you join a co-operative, you don’t actually own your unit. Instead, ownership of both the units and the common areas is split between members.

But don’t worry. You still get to live in your unit in much the same way you would if you actually owned it. And you have privacy rights, so you don’t need to stress about fellow co-op members walking in as they please!

Just like other HOAs, co-ops are managed by a board of directors who are elected by the co-op members.

Co-ops are the least common type of HOA with only 2-4% of HOAs in the U.S. falling into this category. However, they are common in certain regions, most notably New York City.

While rare, they do have some things going for them. Their biggest benefit is that fees and expenses tend to be lower than in a similar planned community or condominium.

Fees

How do HOA fees work?

HOA fees are the least-loved part of being an HOA member. But they are a necessity. Your HOA fees go toward regular expenses within the common-interest development (CID). Those expenses will vary a lot depending on what your HOA offers, but they often include:

- Maintenance and repairs

- Upkeep

- Utilities

- Amenities

- Security

- Insurance

- Landscaping

- Staffing

- Vendor fees

Importantly, a portion of your HOA fees go toward a reserve fund. The reserve fund exists to cover sudden and unexpected expenses, such as a burst pipe or damage from a natural disaster.

» LEARN: What Do HOA Fees Cover and Are They Worth It?

Ask about the health of an HOA’s reserve fund before you purchase your house. The reserve fund has a big effect on another type of HOA fee: the special assessment.

Special assessments are one-off fees that HOA members have to pay to cover unexpected expenses. If an HOA doesn’t have enough money in its reserve fund, then it may have to issue a special assessment.

Even if the reserve fund can cover the expense, a special assessment may still be issued in order to get the reserve fund back to a healthy level.

In some states, like California, a special assessment must be approved by a majority of HOA members if it exceeds a certain threshold. So, you don’t have to fret too much about a board wanting to blow the reserve fund on a new tennis court if most of the HOA members aren’t interested in one.

However, if the special assessment is for an emergency repair, approval of the HOA members is usually not necessary.

HOA Fees and Mortgages:

HOA fees are not a part of your mortgage, but they do play a role in how big of a mortgage you’ll get. Lenders take HOA fees into consideration when deciding your mortgage eligibility. So, higher HOA fees may mean a smaller mortgage.

Wondering how big of a mortgage you may qualify for? Find out below:

How much are HOA fees?

Fees vary dramatically from state to state and even between HOAs within the same region. Some HOAs charge less than $100 per month, while others charge thousands of dollars.

Location plays a big role in how much you’ll pay. The average dues across the 50 largest metropolitan areas in the U.S. are $200-300 per month, but that ranges from a low of $194 in Nashville to $571 in New York City.

The size of your unit is another factor in how much you’ll pay. On average, for every bedroom you add onto your unit, you’ll pay an extra $30 per month in dues.

Finally, the more amenities your HOA offers, the higher the dues will be.

And yes, HOA fees can and often do increase. The increase typically reflects the cost of inflation, as well as any additional expenses that the HOA may incur. One study found that between 2005 and 2015, HOA fee increases outpaced inflation by 5.9%!

Think low HOA dues are a great deal? Not so fast!

Don’t rush into purchasing a home based on bargain HOA fees alone. If the fees are too low, the HOA’s reserve funds may be dangerously low. Or the HOA could be putting off costly but necessary investments in repairs and maintenance.

If there’s not enough money in the reserve fund to cover unexpected expenses, a special assessment will be issued. So, instead of being a deal, those low HOA fees could point to an even bigger bill in the future.

When asking about fee increases, make sure those increases at least keep up with inflation.

Why do HOAs exist?

HOAs have a long history dating back to the 19th-century Garden City movement in the United Kingdom. These Garden Cities were privately owned, planned communities that tried to unite big-city amenities with lots of nature.

The idea of the Garden City was soon imported into the United States, where it was adapted to local conditions. One big innovation with American Garden Cities was that residents still owned their homes, but the community itself was governed by a set of covenants.

While Garden Cities and what we would today call HOAs attracted a lot of attention early on, they were primarily a form of luxury housing. That changed around the 1960s when a number of social, economic, and legal changes led to an HOA boom.

Around this time, the Federal Housing Administration (FHA) adjusted its insurance policies to favor larger, suburban-style developments and also expanded its insurance to cover condominiums.

Large corporations also played a bigger role in real estate development. These corporations had the means to build large developments, especially on the edges of cities where land values were low but amenities were scarce. As a result, it fell to the developer to provide services like parks and streets that would normally be provided by municipalities.

Municipalities realized that HOAs were taking on the expense of what had long been considered municipal service. Facing a budget crunch, many municipalities encouraged the construction of new HOAs in order to lower their own expenses.

That cycle hasn’t let up. Most new housing built today is part of an HOA. Especially in the South and West, HOAs are especially common. When buying a house in these regions, there is a better chance than not that it will be part of an HOA.

Pros & Cons

| Pros of Living in an HOA | Cons of Living in an HOA |

|

|

Pros

Property Values

Property values are a big reason why people like living in HOAs. Everyone within an HOA adheres to the same rules, so, in theory, there is less risk of one bad apple in the neighborhood bringing everybody else’s property values down.

HOAs’ rules are often designed to improve the appearance and quality of the community, such as by limiting the time of day when garbage bins can be left out for collection and standardizing the color of exterior features.

Some research suggests HOAs do raise property values. For example, one study found that HOAs have a positive price impact of 2-17%. Newer HOAs tend to see especially high property value premiums, while in older communities this advantage is less pronounced. The property value premium declines by about 0.4% per year after the HOA is built.

Sometimes, an HOA’s rules can have a surprising — even negative — impact on property values. For example, HOAs that allow cats have higher property values, but those that allow small dogs see lower property values.

Well-Kept Neighborhoods

Communities run by HOAs tend to look pretty good. In a common-interest development (CID), lawns are typically mowed regularly, the doors and trim have a fresh layer of paint, and the flowers are regularly watered.

When HOA members are asked what the biggest benefit of living in an HOA is, "clean/attractive neighborhoods" comes out on top. You simply don’t have to worry when you move into an HOA community that one of your neighbors will build a chain link fence around their front yard or let their grass grow two feet.

That sort of predictability can make your CID look pretty good — and it can make living in one less stressful.

Amenities

Amenities at HOAs vary a lot. Some HOA amenities are modest, such as occasional landscaping services or a barbecue pit. At others, they resemble the offerings of an exclusive resort, with things like golf courses, clubhouses, marinas, and tennis courts.

Granted, the HOAs with the best amenities also have higher fees. But you at least have the freedom to shop around and choose a community whose amenities align with your lifestyle.

A realtor comes in handy when finding an HOA that is best suited to you. Clever can help you find a realtor who knows the HOAs in your area. With a realtor on your side, you can quickly uncover the communities that offer the amenities and lifestyle you’re after.

» FIND: An experienced agent in your area

Fewer Disputes (Kind of)

Bad neighbors are something that can make even the nicest house a lot less pleasant to live in. While an HOA cannot guarantee that you’ll love your neighbors, it can make disputes with neighbors both less common and easier to resolve when they do happen.

In an HOA, everybody follows the same rules. So, before your neighbor can install a 10’ fence or paint their siding neon green, they’ll have to make sure those changes are allowed in the CC&Rs and bylaws (which, no, they probably won’t be).

If a dispute does arise between residents over something that affects the appearance or quality of the neighborhood, the HOA will have a dispute mechanism in place to resolve it. That could mean fewer awkward conversations between you and your neighbor.

Less Maintenance

If you hate mowing the lawn, washing the windows, or shoveling the driveway, you may be well suited to an HOA. In a common-interest development (CID), much of the routine maintenance and upkeep is carried out by the HOA, especially on common areas and external surfaces.

One survey found that, when asked about what the best aspect of living in an HOA is, "maintenance-free" was chosen as the top reason by 19% of HOA members — second only to "clean/attractive neighborhoods."

Granted, the type and amount of maintenance and upkeep an HOA offers varies. Landscaping, window cleaning, and street/driveway clearing are fairly common. Of course, the higher the HOA fee, the more maintenance services you’ll typically receive.

Community Events

HOAs often foster a strong sense of community. Social events are common, especially in communities that boast common areas like clubhouses and barbeque pits. Being an HOA member also often gives you the right to attend annual meetings with the board. This is an opportunity to not only discuss how the HOA is governed, but to also meet fellow HOA members.

Some communities are also geared towards people who are looking for a certain type of lifestyle. HOAs that are exclusively for people aged 55 and over, for example, are common.

Other HOA communities are built around certain recreational activities, such as a golf course or marina. These communities are an opportunity to meet people who share similar interests and values as yourself.

Cons

Restrictions

Living in a pristine-looking HOA comes at a price: restrictions. In order to keep HOA communities looking great, you have to abide by the Covenants, Conditions, and Restrictions (CC&Rs), bylaws, and rules and regulations.

Here’s a look at just some of the things your HOA can and cannot restrict or ban, by law:

| Can Restrict or Ban | Cannot Restrict or Ban |

|

|

Some Surprising Restrictions

Always read the Covenants, Conditions, and Restrictions before buying a house in an HOA-run community. The rules governing HOAs can be far reaching at times and you may find them a bit stifling, especially if you want to renovate your house — or you just have a green thumb and you want to grow your own flowers.

For example, some HOAs require that homes be used strictly for residential purposes. If you run a home business, you could find yourself at odds with your HOA. While many HOAs have been flexible about this rule during the covid-19 pandemic, it’s always a good idea to find out what the expectations are before you buy a home.

If you’re selling goods from your garage and causing customers to line up down the street, you’re more likely to have issues with your HOA than if you are quietly working from a home office.

And while HOAs cannot deny a request for a reasonable accommodation for people with disabilities, there is an important caveat. If the request imposes an undue financial or administrative burden on the HOA, then it can be denied.

Political Signs

Another restriction that often surprises homeowners is on political signs. HOAs often restrict what residents can display on their front lawns, including holiday decorations, commercial advertising, and, yes, political signs.

Only 14 states have laws governing the rights of HOA residents to display non-commercial signs, including political signs. They are:

- Arizona

- California

- Colorado

- Connecticut

- Idaho

- Indiana

- Maine

- Maryland

- Missouri

- Nevada

- New Jersey

- North Carolina

- Washington

- Wisconsin

However, the actual laws vary even between these states. In many, for example, HOAs are still allowed to ban members from displaying non-commercial signs, except in the period leading up to an election.

Clotheslines

Clotheslines are a contentious issue in many HOAs. Some HOA members find them unsightly and want them banned while others believe HOAs should support clotheslines as they consume less energy than dryers.

Some states have adopted "Right to Dry" laws that prohibit HOAs from banning clotheslines. These "Right to Dry" states are:

- Arizona

- California

- Colorado

- Florida

- Hawaii

- Illinois

- Indiana

- Louisiana

- Maine

- Massachusetts

- Nevada

- New Mexico

- Oregon

- Texas

- Utah

- Vermont

- Virginia

- Wisconsin

‘Double Taxation’

Paying HOA fees is more than annoying. For many HOA members, it looks a lot like double taxation. As an HOA member, your HOA fees go towards services that would normally be maintained by the municipality, such as park maintenance, stormwater management, and snow removal.

At the same time, you still pay property taxes that go towards paying for these very same services outside of the common-interest development. Some HOA members see that as an unfair tax since they pay the same tax rate as everyone else in the municipality, but they get fewer services.

Risks for Non-payment of Dues

HOAs have a lot more power than you may realize. One of their most important is the ability to levy fines on HOA members for non-compliance with the community’s rules.

While you do have a right to dispute any fine imposed on you by the HOA, you are still required to pay it. Ignoring a fine is a very bad idea, and it could lead to a lien being placed on your property or foreclosure.

And yes, even if your mortgage is completely paid off, you could still be evicted for not paying your fines.

The laws do vary between states around how easy it is for an HOA to evict members. In Texas, for example, it is fairly easy for an HOA to do so, whereas in Florida a judicial hearing is required first.

The financial repercussions of not paying a fine could get even worse. Many HOAs turn over accounts of non-paying members to law firms. Since those law firms typically don’t charge the HOA any fees, they make their money by charging attorney fees — which can run into the thousands of dollars — to the non-paying member.

Poorly Managed HOAs

The board of directors owes a fiduciary duty to the HOA. They cannot put their own self-interest ahead of the community’s interests. Unfortunately, directors also have a lot of power and access to the HOA’s funds. The result is that accusations of embezzlement, theft, or misuse of funds occasionally happen.

Sometimes HOAs have financial problems not for any nefarious reason, but because of poor management. Instead of investing in necessary repairs to a condominium’s roof, for example, an HOA may decide to invest in a new diving board for the swimming pool.

Many states do require HOAs to conduct regular audits to ensure that funds are being managed properly. To best protect yourself, ask for a copy of the HOA’s most recent financial statements and about what audit requirements they have beyond what the state mandates.

Costs

HOA life does not come cheap. The cost of living in an HOA is about 4% higher than living in a non-HOA community. In the West and South, that figure climbs closer to 10%.

There are two main reasons for the increased cost. The first is that homes in HOAs tend to cost more to buy than non-HOA homes. That’s the property value premium we were talking about earlier.

The second reason is fees. As mentioned above, HOA fees cost between $200-300 on average, but with wide regional variations.

And fees usually increase each year. The following table shows how much you’d pay in total in HOA fees over 20 years if they started at $200 per month and increased by 5% each year (which, by the way, is actually below average):

| Year | Monthly Fees | Total Fees Paid (Cumulative) |

| 1 | 200.00 | 2400.00 |

| 2 | 210.00 | 4920.00 |

| 3 | 220.50 | 7566.00 |

| 4 | 231.53 | 10344.36 |

| 5 | 243.10 | 13261.56 |

| 6 | 255.26 | 16324.68 |

| 7 | 268.02 | 19540.92 |

| 8 | 281.42 | 22917.96 |

| 9 | 295.49 | 26463.84 |

| 10 | 310.26 | 30186.96 |

| 11 | 325.77 | 34096.20 |

| 12 | 342.06 | 38200.92 |

| 13 | 359.17 | 42510.96 |

| 14 | 377.13 | 47036.52 |

| 15 | 395.99 | 51788.40 |

| 16 | 415.79 | 56777.88 |

| 17 | 436.58 | 62016.84 |

| 18 | 458.41 | 67517.76 |

| 19 | 481.33 | 73293.72 |

| 20 | 505.40 | 79358.52 |

As you can see, by year 20, your monthly fees will have more than doubled to over $500 per month. Even worse, you’ll have cumulatively spent over $79,000 in fees over the full 20 years!

The age of your common-interest development (CID) will also have a big impact on fees. Generally, the older the buildings in the CID, the more expensive they are to maintain. So, older HOAs tend to have higher fees, but without necessarily offering better amenities or services than newer ones.

And remember, your regular dues aren’t the only fees you have to pay. Special assessments will pop up from time to time to cover unexpected expenses or to replenish the HOA’s reserve funds.

Don’t assume that your HOA has enough money set aside to cover costly repairs. Close to half of HOAs admit that their reserve funds are inadequate to address major unplanned repairs or replacements. If you happen to be in one of those HOAs, you could easily find yourself hit with a large bill on top of your regular HOA fees.

Your realtor is a great resource for figuring out how much living in an HOA may cost. We can connect you with a local realtor who is familiar with the HOAs in your area, and who can explain to you the fees at each one. That way you can reduce your risk of encountering some unwanted surprises in the future.

» MORE: Buy with a top local realtor

Aging Infrastructure

Speaking of repairs, aging infrastructure is another big problem with many HOAs. About 40% of HOAs say that deteriorating infrastructure is a top concern for them. The issue is especially pronounced in older communities.

Unfortunately, the problem is often exacerbated by the way HOAs are structured. For example, let’s imagine an aging HOA has old pipes that need to be replaced. Because the cost of replacing the pipes is substantial, the board needs to get approval by a majority of HOA members to issue a special assessment.

The members, however, balk at the cost of the special assessment. After all, they’ve never had a problem with their pipes before, so why spend so much on replacing them now? Plus, decaying pipes aren’t a problem that the members can see for themselves. So, it doesn’t seem that urgent.

Time goes on and the pipes continue to deteriorate. They begin to leak, but instead of replacing them, they are simply repaired as needed. Eventually, however, they burst, flooding some of the units. The result is that the cleanup costs are extremely high and the resulting special assessment will be much worse than what it may have been if the issue had been addressed sooner.

The lesson for homebuyers is to ask questions about an HOA’s maintenance record, its fees, and its history of issuing special assessments. If an older HOA-run community seems to have suspiciously low fees or rarely issues special assessments, it could indicate that it is behind on maintaining its infrastructure.

Property Values May Not Increase

Contrary to popular belief, there’s not much evidence to show that HOA homes increase in value faster than non-HOA homes. In fact, one study found that the median annual percent return of HOA homes between 2013 and 2018 was just 3.22% compared to 5.75% for non-HOA homes.

That may sound surprising. After all, we claimed above that HOA homes are generally more expensive than non-HOA homes. That’s true. But don’t be fooled into thinking higher values today means HOA homes will rise in value faster than non-HOA homes in the future. Oftentimes, they don’t.

There is a good theory as to why HOA homes might not be so great for property values. Essentially, it’s because a lot of people really don’t want to live in them. Restrictions on pets, landscaping, renovations, and parking are annoying for those who value their autonomy.

High HOA fees are another disincentive for homebuyers. Even if buyers are interested, lenders factor HOA fees into the mortgage approval process, further limiting the number of potential buyers for HOA homes.

The result is less competition for HOA homes. Without that competition among buyers, HOA home values rise slower than non-HOA homes.

While that theory is difficult to prove, some research suggests it may be onto something. One study, for example, found that HOAs that permitted a variety of home designs attracted higher home prices than HOAs where home designs were standardized.

Buyers, it seems, actually appreciate living in a community where they can be a little more expressive with how their homes look. And they’re willing to avoid overly restrictive HOAs for the privilege.

Societal Impacts

It’s easy to focus on issues like fees, bylaws, and property values when you’re thinking about buying an HOA home. But an often overlooked aspect of HOAs is the impact they have on society as a whole.

One especially significant impact is on municipal services. As we said above, HOA members often feel as though they are being double taxed by having to pay both HOA fees and property taxes. While that may seem unfair to HOA members, it also means that people who live in HOAs are less likely to support increases in taxes and funding for municipal services if their HOA already provides it.

The result is that municipalities have a much harder time raising the tax revenue they need when a significant portion of their population is in an HOA.

This situation creates a feedback loop. Because municipal services are underfunded, homebuyers in these cities are more likely to want to live in an HOA, and that, in turn, leads to further downward pressure on funding for municipal services. It should come as no surprise to learn that HOAs are more common in cities where municipal services are underfunded.

Furthermore, some research suggests that HOAs may exacerbate racial segregation. HOA-run communities are statistically more likely to be more white and Asian than non-HOA communities.

The reason for this is complicated. Of course, HOAs are not allowed to base housing decisions on race or ethnicity. One factor may simply be because people living in HOAs tend to have higher incomes, and incomes are already correlated to race. That is its own problem that is largely separate from HOAs.

However, this doesn’t entirely explain why HOAs are less diverse than non-HOAs. Prejudice is also a likely factor. The same study that found a correlation between poor municipal services and HOAs, for example, also found that people who have a lower tolerance for racial diversity are more likely to want to live in an HOA.

So, while there are certainly benefits to HOAs, you may want to consider what impact living in one will have not just on yourself, but the broader community.

FAQs

What does HOA stand for?

HOA stands for homeowners association. In a condominium, an HOA may be called a COA, which stands for condominium owners association.

What’s the difference between CC&Rs, bylaws, and rules and regulations?

The Covenants, Conditions, and Restrictions (CC&R) is the governing document for the HOA. It sets out how the HOA is structured, how rules are enforced, and the HOA’s assessment and insurance obligations. The CC&R is a legally binding document that is filed with the state and it is difficult to amend. It’s like the HOA’s constitution.

Bylaws are the rules detailing the more day-to-day operations of the HOA, such as voting rights, officer duties, and landscape/exterior requirements.

Rules and regulations are for the really small things that aren’t covered by the CC&Rs or bylaws. They can include items like opening times for the clubhouse or the hours at which garbage must be left on the curb for pickup.

Is an HOA the same as a property manager?

No. An HOA oversees the management and regulation of a common-interest development (CID). A property manager is more directly responsible for the upkeep and maintenance of the CID. HOAs often hire property managers to take care of repairs and maintenance, but the property manager is usually an outside vendor and not a part of the HOA.

What is the difference between a CID and an HOA?

A CID (common-interest development) or CIC (common-interest community) is simply a residential development with common areas and services. The HOA is the organization that oversees the creation and enforcement of rules governing the CID.

In everyday conversation you’ll often hear the term HOA used interchangeably to refer to both the HOA as an organization and the CID that it governs.

How much can HOA fees increase per year?

It depends. In some states, there is no set limit. In others, HOA fee increases are capped, such as at 20% in Arizona. You should always ask for a history of fee increases and if any are planned for the future.

Can I refuse to pay my HOA fines or fees?

No. HOA fines and fees are mandatory and non-payment can lead to a lien on your house or even foreclosure. You do have the right to dispute a fine or fee increase, but it’s best to still pay them by the due date.

How do HOAs affect property values?

It’s complicated. Generally speaking, HOA homes do enjoy a price premium and are valued higher than non-HOA properties. Even non-HOA properties in proximity to HOA properties tend to be valued higher. However, this may simply reflect the fact that HOAs are more likely to appeal to higher-income buyers.

There is less evidence that HOA homes actually increase in value faster than non-HOA homes do. In fact, some research suggests that property values rise faster in non-HOA communities than in HOA ones. Plus, older HOA homes have even less of a property value advantage.

On top of all this, HOA fees and special assessments can easily cancel out whatever property value advantage you may get by buying an HOA home.

No two HOA communities are the same. Research the history of property values in your desired HOA and budget how the fees will affect you. That’s the only way to get a good idea about whether an HOA is worthwhile financially for you.