| Note: When you work with one of our partners, we may earn a small commission. Learn more about our editorial policy and how we make money. |

If you're looking to sell your home, you should be aware the process isn't free. The national average cost to sell a house is $33,529; most homeowners can expect to pay about 9.59% of their home's sale price in selling costs.

This guide will help you figure out exactly what expenses you'll need to budget for, and our selling costs calculator can help you estimate what you'll walk away with if you decide to sell.

If you're looking for ways to lower the costs of selling a house, Semya-Moya can help! We'll match you with top local agents who will list your home for just 1.5% — half the usual rate. Clever is 100% free to use with no obligation. Give it a try today!

Main costs associated with selling a home

The average cost to sell a house usually adds up to about 9.59% of the sale price. Below is a breakdown of some of the larger and more common expenses.

Some of these costs — like closing costs and realtor commissions — are unavoidable. But others — like cleaning and moving costs — can vary depending on your situation.

Below, we'll break down all of these costs so you can get a better idea of what you'll actually end up spending.

You can also use our cost to sell calculator to get an estimate of what your house sale profit will be.

Average home prep costs

| Repair costs | Varies |

| Cleaning costs | $151 |

| Lawn care | $125 |

| Average total | $276+ |

Home prep includes things like repairing your home, cleaning it, and getting it ready to show to potential buyers. How expensive this process is depends on how much work your home needs — and how much you're willing to spend.

Repair costs

Since homes are rarely in perfect condition, buyers will often request sellers to make repairs before completing the sale. They may also request a discount to compensate for the work to be done after closing.

Being proactive in making repairs or improvements can sometimes be a good investment. In particular, updated kitchens tend to improve a home's sale price and help it sell quicker.

Below you can see some common pre-sale repairs and how much they could cost you:

» MORE: Check out the best repairs to make before selling your home

However, not all improvements are a good idea before selling. Avoid changes suited to your personal preferences or ones with a low return on investment. For example, fancy landscaping may appeal to you, but it might not be worth the additional cost to buyers.

Cleaning costs

Depending on the state of your property, you may want to have it professionally cleaned before showings start. The average cost of a deep clean before moving is $151, though this can vary depending on the size of your house and the amount of work necessary.

Lawn care costs

Regardless of whether you take care of your own lawn or pay someone else, this is something you'll want to stay on top of during the selling process. Buyers often drive by properties to check them out before scheduling a showing, so keeping your lawn tidy and organized will maximize curb appeal.

Need help finding someone to help with lawn care or other household chores? TaskRabbit can help you find people in your area who will do same-day work at an affordable rate.

Average marketing costs

| Staging | $2,802 |

| Photography | $151 |

| Yard signs | ~$50 |

| Average total | $3,003 |

Having a quality home to sell is great, but it's also important to showcase your listing in a way that attracts serious buyers.

That's why great marketing is so important. Without high-quality marketing, your home may not get the attention and interest it deserves.

Staging costs

Although not required, most sellers agree that staging their home had a positive impact on their sale price.

Staging can be as small as cleaning your house and putting out a few decorative items to make the place more homey. Or you can have a professional stage your home to make it as appealing as possible to prospective buyers.

Depending on the service, staging could cost anywhere from a few hundred to a few thousand dollars, but most professionals agree it's usually worth it.

» MORE: Learn why staging can make your home sell faster

Photography costs

Having professional pictures taken of your home can be a great way to enhance your listing and increase your chances of getting a high offer.

Some agents include this in their services, but if they don't, you may still want to pay a professional to take some high-quality photos for your listing. This may cost a couple hundred dollars, but it could result in much more interest in your home and potentially better offers.

We strongly encourage you to consider making this relatively small investment — the payoff could be huge.

» LEARN: Why real estate photography might be the most important part of your listing

Yard sign costs

If you work with a realtor, they'll provide a yard sign themselves. However, if you decide to go the for sale by owner (FSBO) route, you'll need to buy your own sign, which will cost you $40–60 for a basic sign with space to write your own information.

Nicer signs that come from a printing service could get into the hundreds of dollars, depending on who you work with and how nice of a sign you want.

» MORE: How much does it cost to sell a house for sale by owner

Average cost of realtor commissions

The single biggest cost to sell your house is agent commissions, which tend to be between 5–6% of the sale price. The current national average for total commission is 5.37%. The seller pays this from the proceeds of the sale.

The buyer's agent and the listing agent each receive a commission, which they then have to split with their respective brokers.

The buyer's agent receives a commission for finding properties that are a good match for their client, scheduling showings, and helping to submit offers. Their commission is usually 2–3% of the home's sale price.What is a buyer's agent?

Listing agents receive their commission for listing, showing, and marketing the property for the seller. Their commission is also usually 2–3% of the home's sale price.What is a listing agent?

How much a realtor charges to sell a house is technically negotiable, though an experienced agent may not always be willing to work for a discounted rate. Fortunately, Clever has already done the work for you by negotiating a pre-discounted rate of 1.5% for sellers.

Clever can help you keep more money in your pocket at closing!

With Clever:

✅ Sellers pay only 1.5% in listing fees

✅ Buyers earn cash back on eligible purchases

✅ You'll work with a local realtor from top brokers, like RE/MAX and Keller Williams

Clever's service is 100% free, with zero obligation. You can interview as many agents as you like, or walk away at any time. Enter your zip code to find a top local agent today!

Average closing costs

Attorney fees

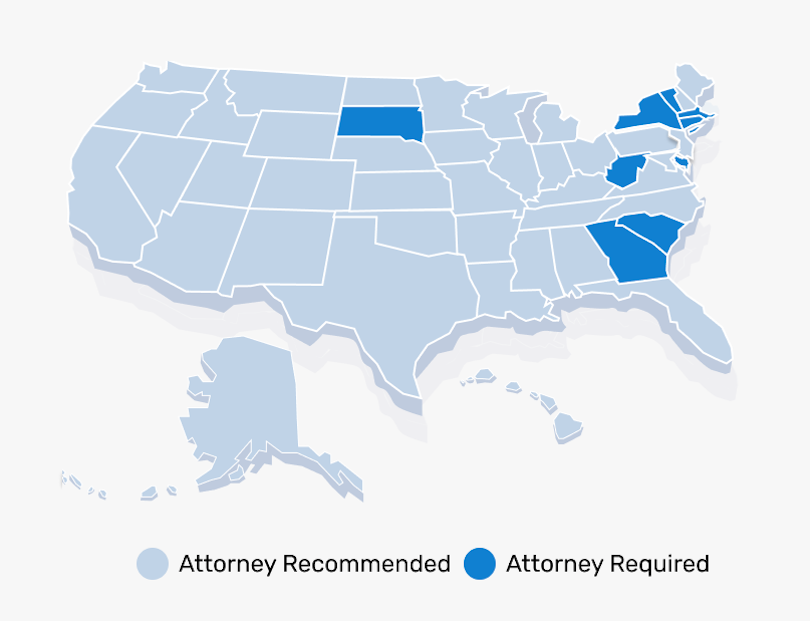

Some home buyers and sellers prefer working with an attorney during a sale to ensure all the paperwork is done correctly and there are no legal issues. In fact, using an attorney is required in the following states:

- Connecticut

- Delaware

- Georgia

- Massachusetts

- New York

- South Carolina

- South Dakota

- Vermont

- West Virginia

Whether legally required or not, you should expect an attorney to cost between $152 to $343 per hour on average for a real estate transaction.

Transfer taxes

Many states require sellers to pay a transfer tax when selling their home. These can range from .05% to 2.25% of the sale price, depending on the state. In the states where transfer taxes exist, they're usually paid by the seller, but there are exceptions to the rule.

There are also states that don't have a transfer tax at all, but you may still have to pay a city or county transfer tax. Check your local laws or with your agent to determine if this is something you should anticipate.

Recording fees

Some states, such as Georgia or North Carolina, charge a recording fee for registering the sale of property. This fee can range from as little as $5 to as much as $750.

Title service fees

Title companies assist in the transfer of property of ownership from one party to another. They verify the original owner has the legal right to sell the property, and they walk you through all the paperwork necessary to ensure a smooth legal transfer. The fee they charge for this service is part of closing costs, and it ranges from a few hundred to thousands of dollars depending on the state.

Title insurance

Title companies offer title insurance to buyers to protect them from any liens or claims on their property. In many states, the buyer covers this expense. When a seller pays for title insurance, the national average is about $1,131.

» MORE: Find out how much title insurance costs in your state

Buyer incentives

Sometimes sellers offer extra incentives to attract more buyers and higher offers. For example, some sellers offer home warranties or seller concessions, which can assist with upfront costs or protect buyers from surprise expenses down the road.

One-year warranties cost about $350–600, and concessions tend to be around 1–3% of the sale price. Sellers need to evaluate for themselves if they think these incentives will pay off.

However, know that whether buyer incentives are offered depends heavily on the local market. If you live in a strong sellers market, it's very likely you can find a buyer without offering any buyer incentives.

» MORE: Learn more about all your possible closing costs

Average moving costs

| Professional movers (local) | $117 per hour |

| Storage unit | $100–300 per month |

If you're selling your primary residence, you'll have to move at some point. This can involve a variety of expenses, whether it be professional movers, renting a truck, or storing your possessions between places.

If you move early, you'll also need to budget for paying two mortgages while you wait for the first property to close.

Factoring in these transition costs ensures you have an accurate idea of how much it will cost to sell your current home and move into the next one.

Professional moving costs

Hiring professional movers for a local move costs about $117 per hour.

You could move your possessions yourself, but most people who do this still need to rent trucks, moving blankets, and equipment for heavy lifting.

Storage unit costs

There's also the possibility of storing your belongings, which involves moving them twice (once to storage and again to your new home) as well as the rent for the storage space.

The average rent for a storage unit is about $100–300 per month.

These home sale expenses don't show up on the closing paperwork, but you still need to account for them if you want an accurate picture of the net proceeds on your home sale.

🚨 Empty houses still cost money

Many sellers forget that just because they aren't living in their home doesn't mean it won't cost them money. In addition to still paying the mortgage, you'll need to keep paying utilities like water, electricity, and heating or cooling until you close.

You should also be aware that some insurance policies don't cover a home when it's vacant. Check with your insurance provider to see if you need to add a rider to cover property while it is empty.

Expenses after closing

The above items are just some of the major expenses involved with selling your home, but they all take place during the sale process.

There's also the possibility of expenses that occur later on, like capital gains taxes. Fortunately, those don't apply if you're selling your primary residence and making less than $250,000 profit (or $500,000 if you file jointly).

There are other rules that determine what your tax liability will be after selling a property. We recommend consulting an attorney or tax advisor to figure out what to expect before making this major financial decision.

» MORE: Learn about other laws that affect your tax liability when selling a house

State-specific costs of selling a home

While costs can vary from one house to the next, depending on the work it needs, there are also variations between states that impact what expenses you'll need to account for. Find your state below to see what home selling expenses you should expect to pay.

How much can I make selling my home?

According to data from ATTOM, the average seller made about $94,000 in profit in 2021 — that's after paying all the costs associated with selling a home.

But, how much money you keep in your pocket after selling your house will depend on several factors, including:

- How you choose to sell your home (realtor, cash buyer, for sale by owner, etc.)

- Which repairs and improvements you do to prep your home for sale

- Whether you make any concessions or offer incentives to buyers

- State and local taxes and closing costs

- Your remaining mortgage balance

Check out our home proceeds calculator to determine precisely how much you could make selling your home.

Additional ways to save on selling costs

Accounting for all the expenses involved in selling your home can get a little overwhelming, but the good news is you have options for keeping these costs manageable.

Negotiate with the buyer

One of the best ways to cut costs is to negotiate the terms of the sale with a buyer. Try to negotiate higher sale prices for anything that costs you additional time or money.

You can also negotiate a convenient closing date to minimize your moving costs, which could end up saving you hundreds or even thousands of dollars.

Try to resist additional expenses that don't get you a good investment on your time and money. For example, if a buyer wants significant renovations that will take extra time to complete, you could end up paying two mortgages while also paying for the work.

Instead, you could negotiate a buyer credit that gives them the money to pay for the work themselves and saves you from having to pay two mortgages simultaneously.

Look for discounted appliances or repair services

You could shop for discounted paint, appliances, or other household items when repairing your home to save some money on the upfront investment.

For example, buying appliances in sets can be a useful strategy, as companies like Whirlpool may offer discounts around 10% off if you buy two or more full-priced items.

You could also hire regular people for assistance with tasks to prepare your house on TaskRabbit. These people can help you do that work to prep your house but at a rate less than a professional painter, cleaner, or mover would charge.

Sell your home FSBO

Some sellers prefer to go the FSBO route and cut out the listing agent fee.

Admittedly, the listing agent fee is a sizable chunk of the costs associated with selling, but be aware that this could result in a substantially lower sale price (not to mention much more work), so it may not be as cost effective as you hope.

According to research by the National Association of Realtors, FSBOs tend to sell for about 28% less than agent-sold properties, and you'll still need to pay closing costs and a buyer's agent fee on top of that.[1]

» MORE: Learn about the pros and cons of selling FSBO

Use a discount agent

Working with an agent may take up the lion's share of your expenses when selling a house, but there's a good reason for this — they do A LOT of work.

With that said, not all agents are the same. Agents provide different levels of service and charge different fees.

Clever has already vetted agents in your area to find the best agents who will work for a discounted rate.

Try our free, no-obligation agent-matching service! Clever will get proposals from the top agents in your area — and negotiate discounted 1.5% listing fees.

Frequently asked questions about costs associated with selling a home

What fees do sellers pay when selling a house?

The main costs associated with selling a home include home preparation costs, marketing costs, agent commissions, closing costs, and moving costs. Most other fees, such as seller concessions and home warranties, are negotiable and generally not required in a seller's market. These expenses may be more necessary if the market favors buyers.

How much will I make on my house sale?

To find the net proceeds on your home sale, add the price you paid, the mortgage balance paid, and all the home selling costs. Whatever the difference is between that total and your sale price is your actual profit on the home.

Do you pay taxes when selling a house?

When selling a house, you're responsible for the property taxes up to the time you close on the sale. You won't have to pay any capital gains tax if the property has been your primary residence for the last two years and you made less than $250,000 profit (or $500,000 if you file jointly). You might have to pay capital gains tax if the house is an investment property.