Getting ready to sell your house in North Carolina? Our in-depth guide breaks the entire process down into 8 simple steps. Learn how to find a great local agent, price your home, negotiate with buyers, breeze through closing, and more!

Now is a good time to be selling a house in North Carolina! According to Zillow Research, property values in the Tar Heel State rose 4.75% in 2019, and are projected to rise a further 3.68% over the next year.

Of course, even the best North Carolina properties will struggle to sell if you don’t price the home properly, do a poor job of marketing it, or don’t know how to handle the negotiations.

Read on to learn the eight steps to successfully selling your home in North Carolina!

» MORE: Get a free, instant home value estimate now!

JUMP TO SECTION

- 1. Finding a North Carolina realtor

- 2. Deciding when to sell

- 3. Pricing your home

- 4. Preparing, marketing, and showing your home

- 5. Fielding offers and negotiations

- 6. Appraisal and inspections

- 7. Paperwork and required North Carolina disclosures

- 8. The closing process

- Next steps: Sell your North Carolina home and save thousands

1. Finding a North Carolina realtor

Selling a home isn’t easy. It’s a high-stakes, complex transaction and requires a considerable amount of time and expertise to get a good outcome. If you’re looking to sell your North Carolina home for the best price — and minimize stress along the way — you need to find a top-rated real estate agent in your area.

The best North Carolina listing agents know exactly what local buyers want and how to reach them. They’ll offer expert advice, guidance, and support every step of the way, from the initial listing all the way through closing.

In fact, sellers who work with real estate agents net 33% more, on average, than those who list on their own. For a $199,157 home — the median home value in North Carolina, according to Zillow — that’s a premium of $65,722. In other words, hiring an agent is well worth the investment.

2. Deciding when to sell

Real estate markets have fairly predictable cycles. Knowing when the market favors sellers and will lead to faster, more profitable sales is crucial to make the most of your sale.

Based on your specific selling goal, you can list your home at the optimal time.

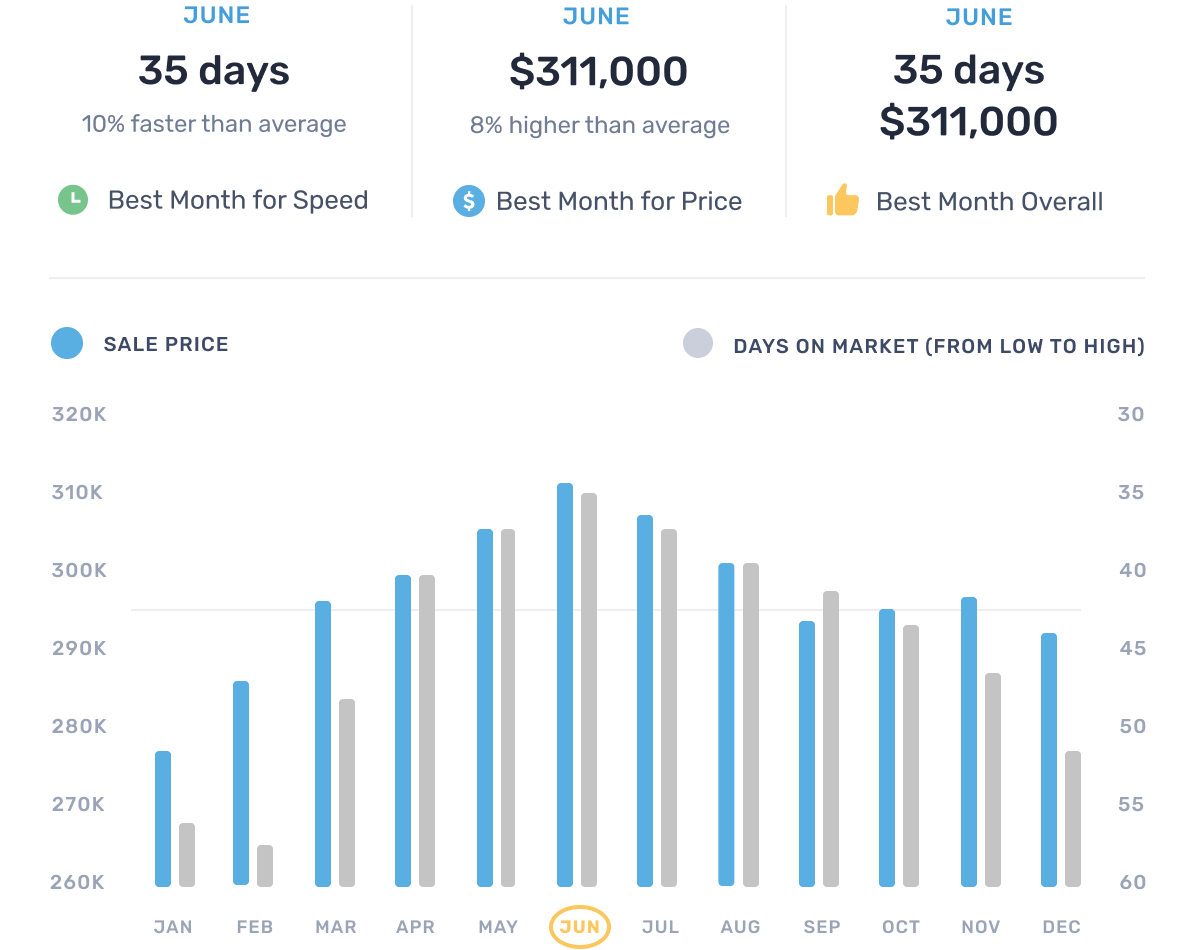

Best time to sell a house across the U.S.

Source: 2019 Redfin Data Center

Best time to sell a house in North Carolina

| Best Month to Sell for Speed in North Carolina | June | 48 days on market | 9 days faster than average |

| Best Month to Sell for Price in North Carolina | June | $255,000 median sale price | 5% more than average |

To get the best price possible for your home timing can be everything. In North Carolina, June is the best month to sell your home for both speed and price.

Homes listed in this month spend 48 days on market — significantly quicker than the Colorado average of 57 days on market. The median sale price of homes listed in June is $255,000, which is almost $12,000 more than average.

It’s also important to look at the health of the state’s economy. If job opportunities look bleak, fewer buyers will be looking to make a huge investment.

In North Carolina, with tech driving a lot of growth in urban metros, cities like Raleigh and Durham have added around 28,000 new jobs and expect to add 24,000 more jobs in the coming year. In more rural areas, employment has been a struggle with a decline in manufacturing jobs.

However, with the state’s unemployment rate decreasing to 3.4%, more people can now afford to look at buying homes.

And right now, overall it’s a seller's market in North Carolina as there’s less than a six-month housing supply. You’ll find there’s a lot of competition for your home.

Learn More: The Best Time to Sell a Home in North Carolina

3. Pricing your home

Pricing your home too high or too low could cause your home to linger on the market with buyers losing interest or could cause your home to sell quickly, but at well under your asking price where you walk away unable to come out on top, let alone even.

This is why it’s immensely beneficial to get a comparative market analysis (CMA). A CMA compares your home’s value to similar surrounding homes in your neighborhood.

A CMA will take into account your neighborhood such as quality of schools, the size of your home vs others, as well as the amenities your home offers compared to your neighbor’s.

Will all of these considerations factored in to your CMA, your real estate agent will then be able to best price your home accurately and competitively so you see more buyer offers roll in.

For instance, in Raleigh, NC the median listing price is $326,900 with median sales prices at $257,200. In Charlotte, NC, however, the median listing price is significantly lower at $297,500 with median sold prices at $231,500.

If you list your Charlotte home at the higher Raleigh median listing price, most buyers will skip over your home thinking it’s far too overpriced compared to other homes being sold in the area.

But with a CMA you can avoid the situation above. Your real estate agent will be able to help you get a proper CMA and with a Clever Partner Agent, they will prepare a comparative market analysis at no cost.

But if you're earlier in the process and just want a general idea of what your house is worth, a free online home value estimator is a great place to start. Enter your address below to see your estimated sale price, as well as useful local real estate market trends. Find out how much your house is worth now!

Discover the true value of your home with our Home Value Estimator!

4. Preparing, marketing, and showing your home

Before you put your home on the market, you’ll want to spruce it up to make your house more appealing to buyers. One easy and completely free way to make your home more inviting is to simply declutter.

Make sure your kid’s art projects or family photos are tucked away; extraneous computer cables, papers, etc. are cleaned up, and any bulky, outdated furniture is out of sight. This will help buyers envision themselves living in the space.

Polishing up and making repairs to the bathroom and kitchen usually get you the most return on investment. Put a fresh coat of paint in the bathroom, paint cabinets or even replace some cabinet hardware like handles so they have a more clean and modern look.

Most buyer’s first impression of your home will be online. This is where hiring professional photographers can make a difference. They will know how to light your home and photograph the best angles to highlight your home’s best features, that in turn, will entice buyers.

In North Carolina, buyers will be looking for homes that are energy efficient. With milder to hot seasonal temperatures, putting in an HVAC system will attract buyers who are conscious of energy saving.

Additionally, because North Carolina is a more temperate climate, having an attractive outdoor space or patio will lure in more buyers who imagine themselves having barbeques or a relaxing glass of wine outside in the evenings.

In order to sell your home faster, you’ll want to be well prepared for the open house. Make sure to remove bulky furniture and consider having your agent stage your home. They’re experts at knowing what buyers want.

Make sure you and your pets are not there for the open house. Buyers don’t want to see the homeowner lurking. You can also consider going with a lockbox where the agent and buyer can enter your home when you’re on vacation or if you’re already moved out.

Learn More: The Best Paint Colors For Selling A House

5. Fielding offers and negotiations

You’ll want to get the best price for selling your home and well, buyers will too. This is where negotiations and counteroffers come into play.

Before you begin negotiations, know exactly what you’re willing to bargain for. Will you be willing to pay closing costs? Are you taking the washer and dryer with you or would you be willing to leave them for a price?

In North Carolina, once you do come to an agreement between you and the buyer, you’ll enter into what is called the due diligence period lasting usually from 14 to 30 days once the contract is signed.

The buyer will also pay a due diligence fee to cover inspections as well as an earnest money deposit, usually ranging from 1% to 2% of the purchase price to help protect you as the seller in the case the buyer backs out at the last minute.

Learn More: Real Estate Counter Offer Etiquette

6. Appraisal and inspections

Before you sell your home, getting an appraisal is beneficial so you get an idea of your home’s value and how well it will do on the market. If your home receives a positive appraisal more lenders will be willing to loan out funds for buyers to purchase your home.

Home inspections are important for both sellers and buyers so there’s no chance of a buyer purchasing a home and then attempting to sue you later over damage that wasn’t disclosed in an inspection.

With the inspection, know what repairs you as the seller should be responsible for — major issues like structural damage, HVAC problems, and especially in North Carolina, termites are a problem for many homes. You’ll be responsible for exterminating any pests.

Learn More: Can the Seller Back Out of Contract Before Closing?

7. Paperwork and required North Carolina disclosures

Seller disclosures protect both you and the buyer. North Carolina law requires sellers to tell any known home defects to the buyer, so the buyer isn’t surprised when they move in to find water damage or an animal infestation.

The disclosure also protects you as the seller from any future litigation instigated by the buyer claiming you must fix a problem they knew was there previously before buying the home.

In North Carolina, you’ll be required to fill out a four-page disclosure form asking questions ranging from if there are structural problems and radon issues to if your ceiling fans don’t work. Make sure you disclose everything so you save yourself potential headaches down the road.

There might be additional legal documents you need to close on your home; always consult your agent or attorney before signing or filing paperwork. A licensed professional should walk you through all the paperwork and ensure you have everything you need for your situation.."

Forms and Documents for Selling a House in North Carolina

Required for All Real Estate Sales in North Carolina

- 2 Forms of ID

- Copy of Purchase Agreement and Any Addendums

- Closing Statement

- Signed Deed

- Bill of Sale

- Affidavit of Title

Possible Additional Documents

- Loan Payoff Information

- HOA Forms and Guidelines

- Survey Results or Survey Affidavits

- Home Inspection Results

- Proof of Repairs or Renovations

- Home Warranty Information

- Copies of Relevant Wills, Trusts, or Power of Attorney Letters

- Relevant Affidavits (Name Affidavits, Non-Foreign Affidavit Under IRC 1445, etc.)

- Closing Disclosure (for certain seller concessions)

- Correction Statement and Agreement

- City and County Tax Revenue Declaration

North Carolina Disclosure Forms

- Residential Property Disclosure Statement

- Flood Zone Statement

- Lead-Based Paint Disclosure

Learn More: Disclosure Requirements in North Carolina

8. The closing process

The closing process involves all parties to sign documents and transfer funds so the home is legally handed over to the new owner. In North Carolina, sellers and buyers must work with attorneys when transferring ownership of a home.

You should have your own attorney representation who will work with real estate agents and lenders to not only coordinate the closing but to make sure the money is transferred properly and everything is handled in a timely manner.

As the seller, you’ll be responsible for paying for some closing costs such as deed preparation and tax stamps. If you live in a more rural area of North Carolina, also be prepared that buyers may ask for you to pay part of the cost for surveys.

Learn More: How Much Are Seller Closing Costs in North Carolina

Next steps: Sell your North Carolina home and save thousands

Whether you’re looking to list your North Carolina home immediately or 6-12 months from now, it’s never too early to start looking for an agent, getting advice, and making a plan.

Clever is here to help guide you through the home selling process — and save money along the way!

Want to find a top local agent without overpaying on realtor fees? Clever negotiates 1.5% listing fees with top-rated realtors from trusted brokerages like Keller Williams, RE/MAX, and Berkshire Hathaway.

Get guaranteed full service for a fraction of the 3% rate agents typically charge. Schedule a free, no obligation consultation with a top local agent today!

Top ways to sell your home in North Carolina

- Discount real estate agents in North Carolina

- We Buy Houses for Cash companies in North Carolina

- Flat-fee MLS companies in North Carolina

- iBuyers in North Carolina

Additional resources for North Carolina home sellers

- Average cost to sell in North Carolina

- Average time to sell in North Carolina

- How to sell by owner in North Carolina

- Transfer taxes in North Carolina

- Sell "as is" in North Carolina